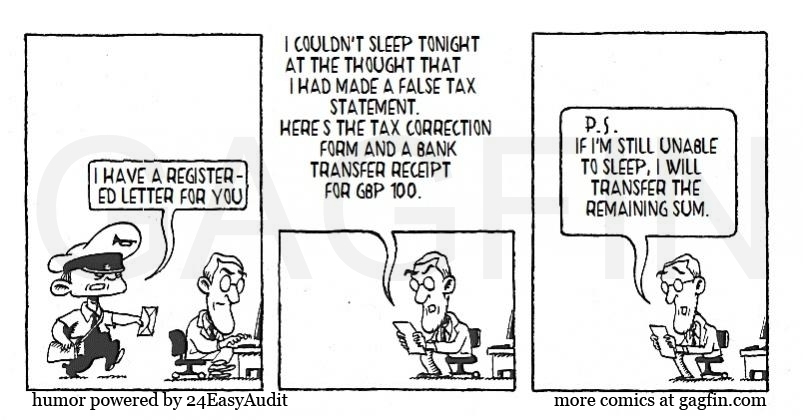

The new tax year has just started and the first income tax returns for the previous year have been received by the tax offices as well as first corrections. Appropriate voluntary disclosure is a good starting point. Henry knows that such disclosing taxpayer will save on consulting services as a result of the price attractive expert service and in effect such taxpayer will afford to pay any outstanding taxes.

When do we have to correct the PIT return?

Tags: corporate taxation corporation tax how to calculate corporate tax

Facebook comments