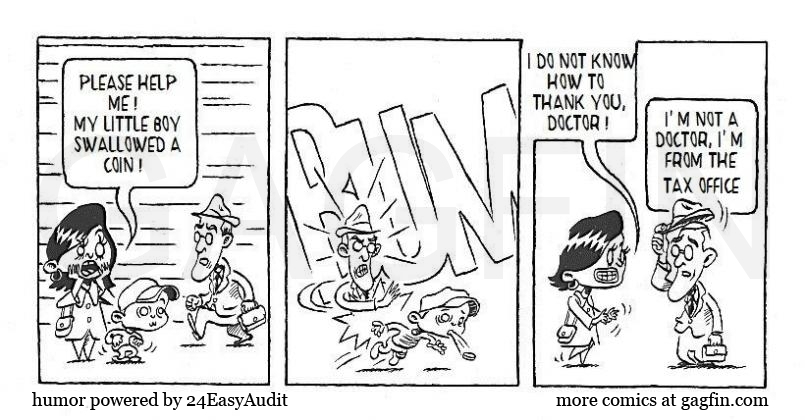

Henry is a good man. We can see that 20 years of work at the internal revenue office and large experience, in particular in fiscal inspection and collection, has produced a lot. He could easily work in a kindergarten or run a nursery school. I wonder if he is as efficient in controlling CIT tax? The taxpayers controlled by Henryk had better learn more about balance sheet and tax closing for 2015. They will be sure then of their calculations.

When you can count on Tax Authorities?

Tags: Cash flow statement deferred tax asset deferred tax liability auditing audit tests audit documentation corporation tax

Facebook comments